menu

menu menu

menu

Waiting for something unknown.✨

My Very First Auction! Includes an extremely high detailed high quality framed and signed 13×19 inch archival print with Claria inks on archival photo paper. #NFTs #nftcollectors #NFTCommunity #ArtificialIntelligence https://opensea.io/assets/0x495f947276749ce646f68ac8c248420045cb7b5e/77846868383147194692393828987280426225215541060700937143586910561610311401473

My Very First Auction! Includes an extremely high detailed high quality framed and signed 13×19 inch archival print with Claria inks on archival photo paper. #NFTs #nftcollectors #NFTCommunity #ArtificialIntelligence https://opensea.io/assets/0x495f947276749ce646f68ac8c248420045cb7b5e/77846868383147194692393828987280426225215541060700937143586910561610311401473

2 collectors

2 collectors TormanJeremyMy Very First Auction! Includes an extremely high detailed high quality framed and signed 13x19 inch archival print with Claria inks on archival photo paper. #NFTs #nftcollectors #NFTCommunity #ArtificialIntelligence https://opensea.io/assets/0x495f947276749ce646f68ac8c248420045cb7b5e/77846868383147194692393828987280426225215541060700937143586910561610311401473

TormanJeremyMy Very First Auction! Includes an extremely high detailed high quality framed and signed 13x19 inch archival print with Claria inks on archival photo paper. #NFTs #nftcollectors #NFTCommunity #ArtificialIntelligence https://opensea.io/assets/0x495f947276749ce646f68ac8c248420045cb7b5e/77846868383147194692393828987280426225215541060700937143586910561610311401473To the Future Ppl !This is the first piece of a Fan Art series I´m planning! To celebrate Back to the Future 35years I´ve built a replica of Hill Valley courthouse Iconic scene.

#Backtothefuture #3Danimation #NFTartist #NFT #NFTs #nftcollector #cryptoart #NFTartist #NFTCommunity

To the Future Ppl !This is the first piece of a Fan Art series I´m planning! To celebrate Back to the Future 35years I´ve built a replica of Hill Valley courthouse Iconic scene.

#Backtothefuture #3Danimation #NFTartist #NFT #NFTs #nftcollector #cryptoart #NFTartist #NFTCommunity

2 collectors

2 collectors Lucasf_3dTo the Future Ppl !This is the first piece of a Fan Art series I´m planning! To celebrate Back to the Future 35years I´ve built a replica of Hill Valley courthouse Iconic scene.

#Backtothefuture #3Danimation #NFTartist #NFT #NFTs #nftcollector #cryptoart #NFTartist #NFTCommunity

Lucasf_3dTo the Future Ppl !This is the first piece of a Fan Art series I´m planning! To celebrate Back to the Future 35years I´ve built a replica of Hill Valley courthouse Iconic scene.

#Backtothefuture #3Danimation #NFTartist #NFT #NFTs #nftcollector #cryptoart #NFTartist #NFTCommunitycryptonio123 outbids @14Ovie with a bid of 22.5Ξ ($42,916.86)

💜Sweet Dreams💜 is the final piece to be minted on @SuperRare before the @mbsjq @niftygateway drop on April 12

cryptonio123 outbids @14Ovie with a bid of 22.5Ξ ($42,916.86)

💜Sweet Dreams💜 is the final piece to be minted on @SuperRare before the @mbsjq @niftygateway drop on April 12

Are you still awake, maybe you can’t sleep because you need to collect another #NFT 💤 here would be my suggestion. #nftcollectors

Are you still awake, maybe you can’t sleep because you need to collect another #NFT 💤 here would be my suggestion. #nftcollectors

atomizedbits

atomizedbits Dario_DesienaAre you still awake, maybe you can't sleep because you need to collect another #NFT 💤 here would be my suggestion. #nftcollectors

https://opensea.io/assets/0x495f947276749ce646f68ac8c248420045cb7b5e/38039128345254064647589517671143081133011420513097535766912356045203557056518

Dario_DesienaAre you still awake, maybe you can't sleep because you need to collect another #NFT 💤 here would be my suggestion. #nftcollectors

https://opensea.io/assets/0x495f947276749ce646f68ac8c248420045cb7b5e/38039128345254064647589517671143081133011420513097535766912356045203557056518‘Gatekeeper Of The Void’

now available only on @SuperRare⚔️

https://superrare.co/artwork-v2/gatekeeper-of-the-void-20966

💎 UPSTREAM 💎

✨ Artwork by @retricdreams

💰 Sold to @8888Benji for 5.534 ETH ($10,090.70)

💎 UPSTREAM 💎

✨ Artwork by @retricdreams

💰 Sold to @8888Benji for 5.534 ETH ($10,090.70)

💎 Middleworld 💎

✨ Artwork by @dangiuz

💰 Sold to @8888Benji for 30.0 ETH ($54,751.50)

💎 Middleworld 💎

✨ Artwork by @dangiuz

💰 Sold to @8888Benji for 30.0 ETH ($54,751.50)

Look what I just discovered on @opensea! #nft #opensea https://opensea.io/assets/0x495f947276749ce646f68ac8c248420045cb7b5e/75451380373905500449998232576219386451925965340495745736748109861852066873345

Yo @tomorchrd‘s “Hidden Wakizashi” just totally 🤯 my mind. Insane talent! https://superrare.co/artwork-v2/hidden-wakizashi-17155 #NFT #nftart #NFTartists

Yo @tomorchrd‘s “Hidden Wakizashi” just totally 🤯 my mind. Insane talent! https://superrare.co/artwork-v2/hidden-wakizashi-17155 #NFT #nftart #NFTartists

tomorrow we will be dropping “satoshi collection” other than the artist and various small parties only @APompliano has seen the full collection | let’s just say ~ there is a ton of interest 👀 ~~ 300 RTs we drop previews early

tomorrow we will be dropping “satoshi collection” other than the artist and various small parties only @APompliano has seen the full collection | let’s just say ~ there is a ton of interest 👀 ~~ 300 RTs we drop previews early

@harsha_nik @KnownOrigin_io @NFTStock @cryptotalk @Loganthedudee @nft__community @NFTChairman here’s a hidden gem 🙂 https://opensea.io/assets/0x495f947276749ce646f68ac8c248420045cb7b5e/1320647387308535254427024482131342257786249516275092859116705941784476254211

Dropping 10/03/2021 on @withFND

unknown yet verified | we will be posting purchasing procedures very soon – make sure to click the bell | “satoshi collection” drops 03-09-2021

“Reduce options. Increase focus. Multiply results.” — @behaviorgap

Imagine lucking into the one-in-a-bazillion chance to be alive, and you squander it by living the preferences of others.

🪐Auction will end in 1h 🪐

at @opensea

Don’t miss it. ⏰

#nft #nftart #nftsrtist #cryptoartist

@sabet @LUVELLI @SwanVR @WakingCosmos @alexandermazzei @RutledgeMj

🪐Auction will end in 1h 🪐

at @opensea

Don’t miss it. ⏰

#nft #nftart #nftsrtist #cryptoartist

@sabet @LUVELLI @SwanVR @WakingCosmos @alexandermazzei @RutledgeMj

atomizedbits

atomizedbits Dario_Desiena🪐Auction will end in 1h 🪐

at @opensea

Don’t miss it. ⏰

#nft #nftart #nftsrtist #cryptoartist

@sabet @LUVELLI @SwanVR @WakingCosmos @alexandermazzei @RutledgeMj

https://opensea.io/assets/0x495f947276749ce646f68ac8c248420045cb7b5e/38039128345254064647589517671143081133011420513097535766912356040805510545409

Dario_Desiena🪐Auction will end in 1h 🪐

at @opensea

Don’t miss it. ⏰

#nft #nftart #nftsrtist #cryptoartist

@sabet @LUVELLI @SwanVR @WakingCosmos @alexandermazzei @RutledgeMj

https://opensea.io/assets/0x495f947276749ce646f68ac8c248420045cb7b5e/38039128345254064647589517671143081133011420513097535766912356040805510545409

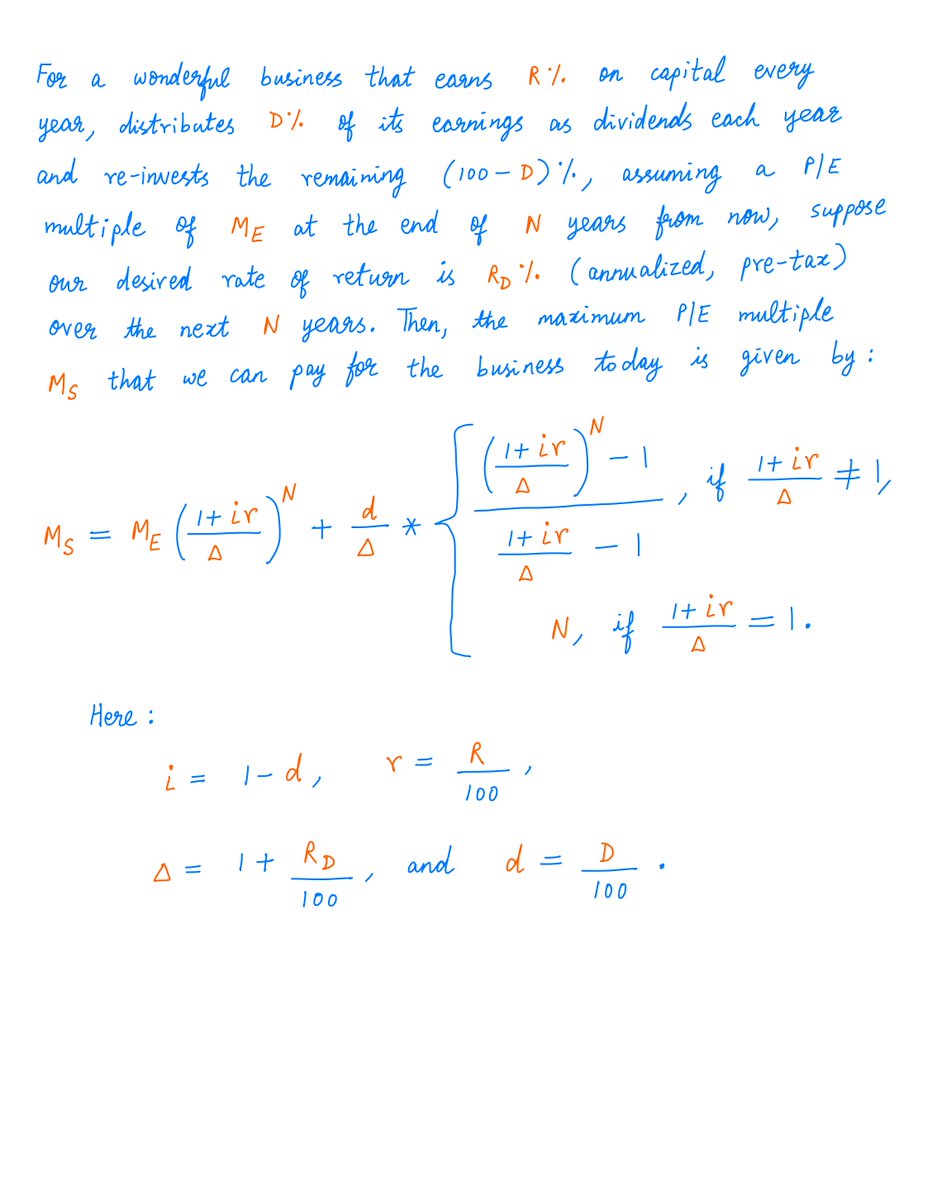

10-K Diver @10kdiver1/

Get a cup of coffee.

In this thread, I'll help you understand Warren Buffett's famous quote: it's better to buy a wonderful business at a fair price than a fair business at a wonderful price. twitter.com

10-K Diver @10kdiver1/

Get a cup of coffee.

In this thread, I'll help you understand Warren Buffett's famous quote: it's better to buy a wonderful business at a fair price than a fair business at a wonderful price. twitter.com

no #NFT will be sold for more than 1$ by rekodi || we are democratizing access to scarce art || “satoshi collection” drops 03-09-2021

no #NFT will be sold for more than 1$ by rekodi || we are democratizing access to scarce art || “satoshi collection” drops 03-09-2021

“We don’t want the thing we’re after, we want to be after the thing.” — @jonathanwilson

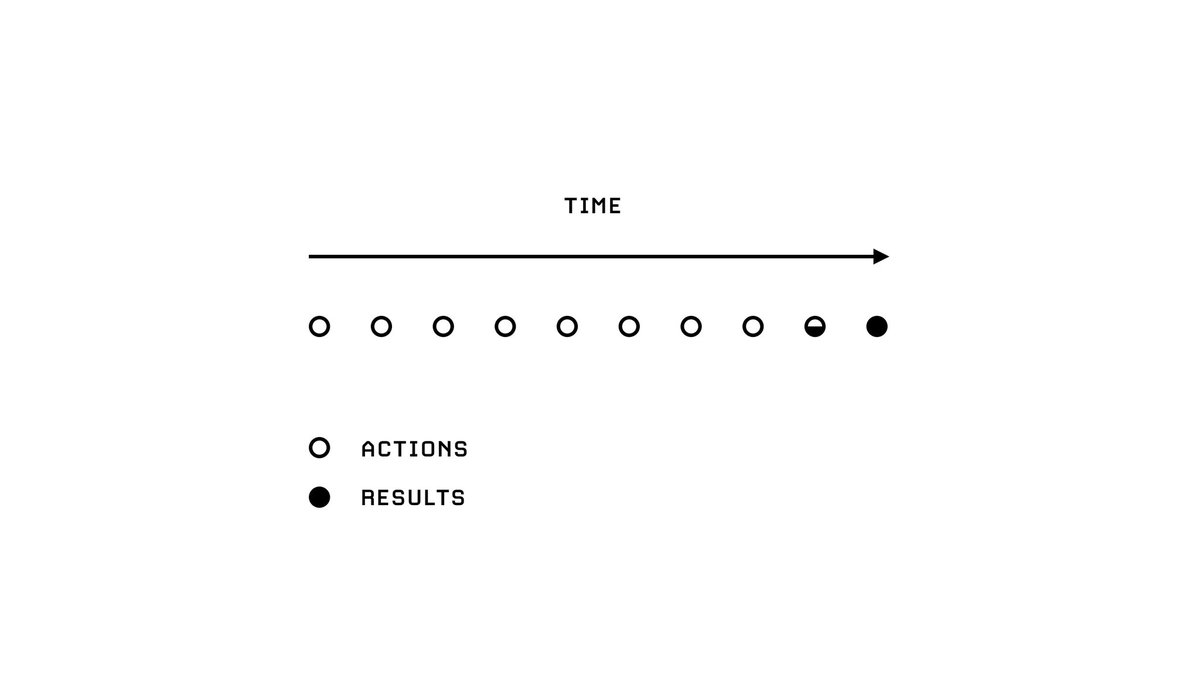

“Impatience with actions, patience with results.” — @naval

unknown yet verified || “satoshi collection” drops 03-09-2021

Pay what you can

Pay what you can