menu

menu menu

menu

Sahil Bloom @SahilBloom1/ Short Selling 101

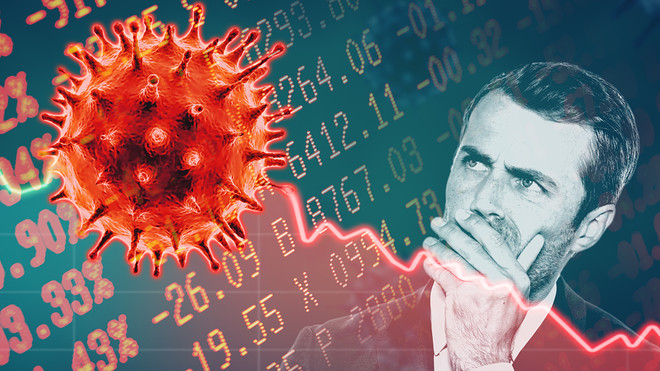

With the markets continuing to rally, there has been more talk of “shorting” or “short selling” stocks.

But what does that mean and how does it work?

Here’s a quick educational primer: Short Selling 101 twitter.com

Sahil Bloom @SahilBloom1/ Short Selling 101

With the markets continuing to rally, there has been more talk of “shorting” or “short selling” stocks.

But what does that mean and how does it work?

Here’s a quick educational primer: Short Selling 101 twitter.com

Sahil Bloom @SahilBloom1/ An Allegory of Finance

I have been posting a lot of educational (and humorous!) threads on finance, money, and economics.

My mission is simple: to demystify these concepts and make them accessible to everyone.

All of the threads can be found below. Enjoy and please share! twitter.com

Sahil Bloom @SahilBloom1/ An Allegory of Finance

I have been posting a lot of educational (and humorous!) threads on finance, money, and economics.

My mission is simple: to demystify these concepts and make them accessible to everyone.

All of the threads can be found below. Enjoy and please share! twitter.com

Sahil Bloom @SahilBloom1/ Options 101 - Call Options

Over the last few months, with the rise of Robinhood and the day trading boom, options trading has been featured prominently in the news (for better or for worse).

But what is an option and how does it work?

Here’s Options 101 - Call Options! twitter.com

Sahil Bloom @SahilBloom1/ Options 101 - Call Options

Over the last few months, with the rise of Robinhood and the day trading boom, options trading has been featured prominently in the news (for better or for worse).

But what is an option and how does it work?

Here’s Options 101 - Call Options! twitter.com

Sahil Bloom @SahilBloom1/ Short Selling 101

With the markets continuing to rally, there has been more talk of “shorting” or “short selling” stocks.

But what does that mean and how does it work?

Here’s a quick educational primer: Short Selling 101 twitter.com

Sahil Bloom @SahilBloom1/ Short Selling 101

With the markets continuing to rally, there has been more talk of “shorting” or “short selling” stocks.

But what does that mean and how does it work?

Here’s a quick educational primer: Short Selling 101 twitter.com

Sahil Bloom @SahilBloom1/ Options 101 - Put Options

Yesterday, I posted Part 1 of Options 101, covering call options. I can’t leave my Bears hanging (the market has done enough of that!), so it only feels right that I cover put options next.

Here’s Options 101 - Put Options! twitter.com

Sahil Bloom @SahilBloom1/ Options 101 - Put Options

Yesterday, I posted Part 1 of Options 101, covering call options. I can’t leave my Bears hanging (the market has done enough of that!), so it only feels right that I cover put options next.

Here’s Options 101 - Put Options! twitter.com

Sahil Bloom @SahilBloom1/ Options 101 - Put Options

Yesterday, I posted Part 1 of Options 101, covering call options. I can’t leave my Bears hanging (the market has done enough of that!), so it only feels right that I cover put options next.

Here’s Options 101 - Put Options! twitter.com

Sahil Bloom @SahilBloom1/ Options 101 - Put Options

Yesterday, I posted Part 1 of Options 101, covering call options. I can’t leave my Bears hanging (the market has done enough of that!), so it only feels right that I cover put options next.

Here’s Options 101 - Put Options! twitter.com

Sahil Bloom @SahilBloom1/ A Thread on Markets

It is the year 1500 and you enter a market in Renaissance-era Italy.

There are buyers and there are sellers. Prices of the various goods are determined by the interaction by and among these individuals.

Now in walks Mr. FEDerico, a man of endless means. twitter.com

Sahil Bloom @SahilBloom1/ A Thread on Markets

It is the year 1500 and you enter a market in Renaissance-era Italy.

There are buyers and there are sellers. Prices of the various goods are determined by the interaction by and among these individuals.

Now in walks Mr. FEDerico, a man of endless means. twitter.com

Sahil Bloom @SahilBloom1/ Options 101 - Call Options

Over the last few months, with the rise of Robinhood and the day trading boom, options trading has been featured prominently in the news (for better or for worse).

But what is an option and how does it work?

Here’s Options 101 - Call Options! twitter.com

Sahil Bloom @SahilBloom1/ Options 101 - Call Options

Over the last few months, with the rise of Robinhood and the day trading boom, options trading has been featured prominently in the news (for better or for worse).

But what is an option and how does it work?

Here’s Options 101 - Call Options! twitter.com

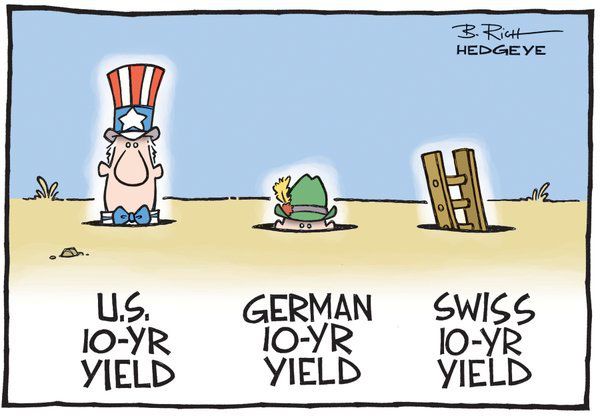

Sahil Bloom @SahilBloom1/ Bonds & Yields 101

If you follow the financial news, you see and hear a lot of talk about bonds and bond yields.

But what are they and how do they work?

Here’s Bonds & Yields 101! twitter.com

Sahil Bloom @SahilBloom1/ Bonds & Yields 101

If you follow the financial news, you see and hear a lot of talk about bonds and bond yields.

But what are they and how do they work?

Here’s Bonds & Yields 101! twitter.com

Pay what you can

Pay what you can