menu

menu menu

menu

[ login with Twitter or Facebook ]

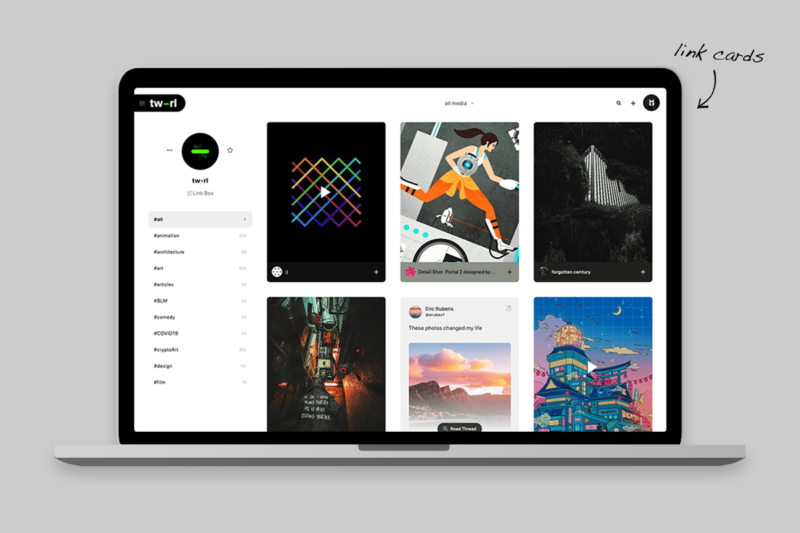

[ grab a URL to create a link card ]

[ group cards via #gallery #tags ]

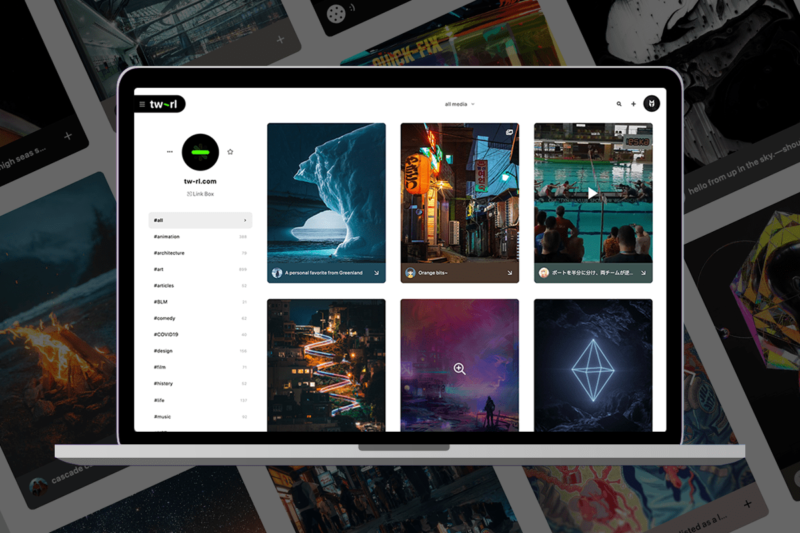

Save tweets, threads, images or videos from your favorite sites and display them as media-rich cards in sharable (or private) galleries.

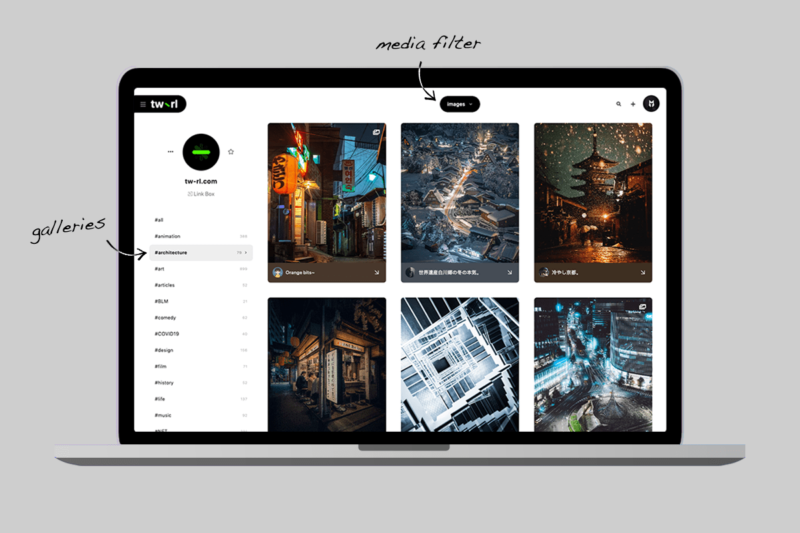

Group cards into galleries using #hash #tags. You can also filter cards by media like images, videos, links, and words… automatically.

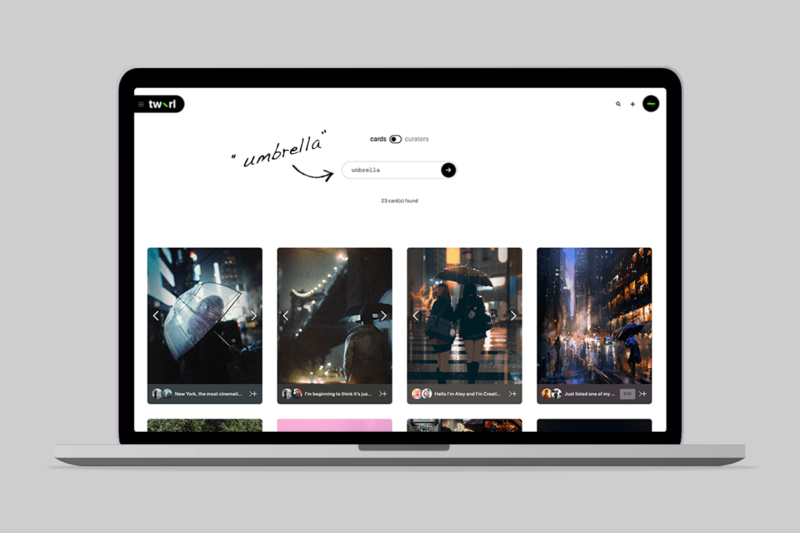

tw-rl uses machine-learning AI that can “see” text and objects in images, making it easier to find exactly what you’re looking for.

Collect unlimited link cards, run a newsletter or permanently save all your links (coming soon) when you upgrade to Pro Curator.

examples

examplesWe take you behind the scenes of world-class design.

Subscribe to be the first to know when we go live.

We take you behind the scenes of world-class design.

Subscribe to be the first to know when we go live.

“Parking lot 35 #b3d #bnpr #animation”

“Parking lot 35 #b3d #bnpr #animation”

It only took me 2 DAYS to create this beautiful Lofi animation 🔥🔊

Bringing AI pictures to life is way easier than you think.

EVERYONE can do it.

These are the 8 steps you should follow 👇

“After you solve the biggest problem, something else becomes the biggest problem.” – @balajis

This has been called ‘the most annoying gif on the Internet’ [ https://buff.ly/30DLya6 ] but it has some interesting references, because it’s a kind of a visualization in gif form of the concept of coastlines’ fractal dimension: https://buff.ly/3ny2zv7

This has been called ‘the most annoying gif on the Internet’ [ https://buff.ly/30DLya6 ] but it has some interesting references, because it’s a kind of a visualization in gif form of the concept of coastlines’ fractal dimension: https://buff.ly/3ny2zv7

Yixing clay teapots are made from Yixing clay. This traditional style originated in China, dating back to the 15th century, and are made from clay produced near Yixing in the eastern Chinese province of Jiangsu

[read more: https://buff.ly/3MtWjA2 ]

Yixing clay teapots are made from Yixing clay. This traditional style originated in China, dating back to the 15th century, and are made from clay produced near Yixing in the eastern Chinese province of Jiangsu

[read more: https://buff.ly/3MtWjA2 ]

I’m trying to find a of sweet spot between organic and mechanical. Also, there could be little creatures living inside these things. Doing maintenance etc. 🤖 #pixelart #indiegame #gamedev #scifiart #xbox #RETROGAMING

I’m trying to find a of sweet spot between organic and mechanical. Also, there could be little creatures living inside these things. Doing maintenance etc. 🤖 #pixelart #indiegame #gamedev #scifiart #xbox #RETROGAMING

A larger A4 sketchbook I’ve been working on for a few months

「帰り道の全力疾走」

正直、技術的にはまだまだなころの絵なんですが、雰囲気が気に入っている作品です。

少しでもノスタルジーを感じていただければ嬉しいです。

GM! the #tezaissance is upon us! If any collectors or artists need to go back to school for a quick refresher or to learn the ropes of tex, let me know!

GM! the #tezaissance is upon us! If any collectors or artists need to go back to school for a quick refresher or to learn the ropes of tex, let me know!

Join the newsletter for news + updates 👇

Pay what you can

Pay what you can