menu

menu menu

menu

10-K Diver @10kdiver1/

Get a cup of coffee.

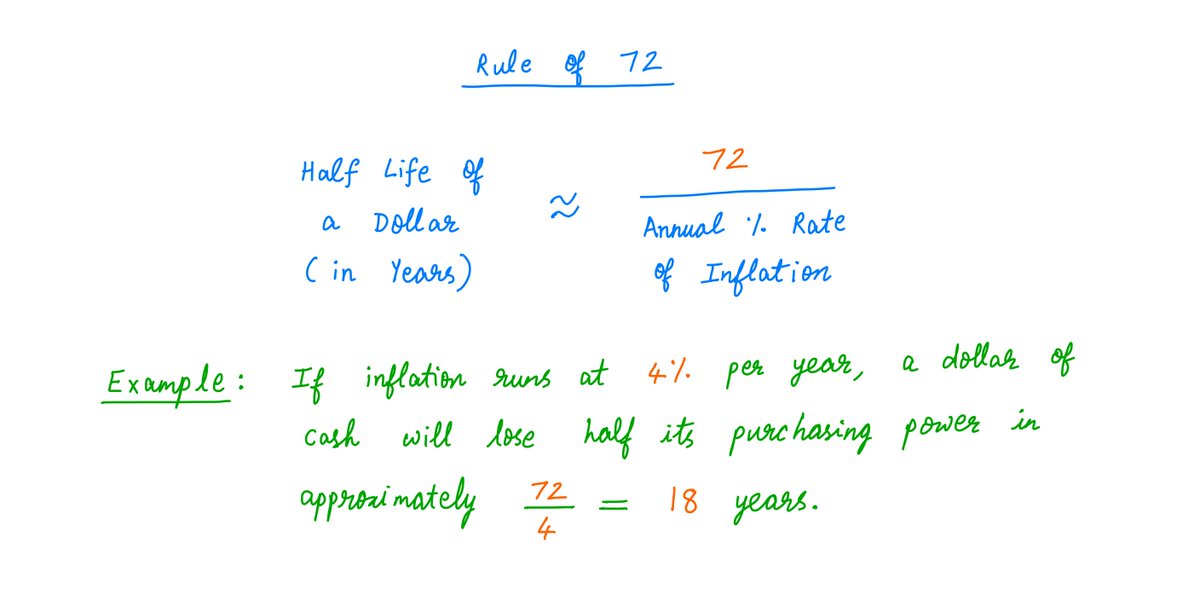

In this thread, I'll walk you through the Rule of 72 -- and related "mental math tricks" for investors. twitter.com

10-K Diver @10kdiver1/

Get a cup of coffee.

In this thread, I'll walk you through the Rule of 72 -- and related "mental math tricks" for investors. twitter.com

10-K Diver @10kdiver1/

Get a cup of coffee.

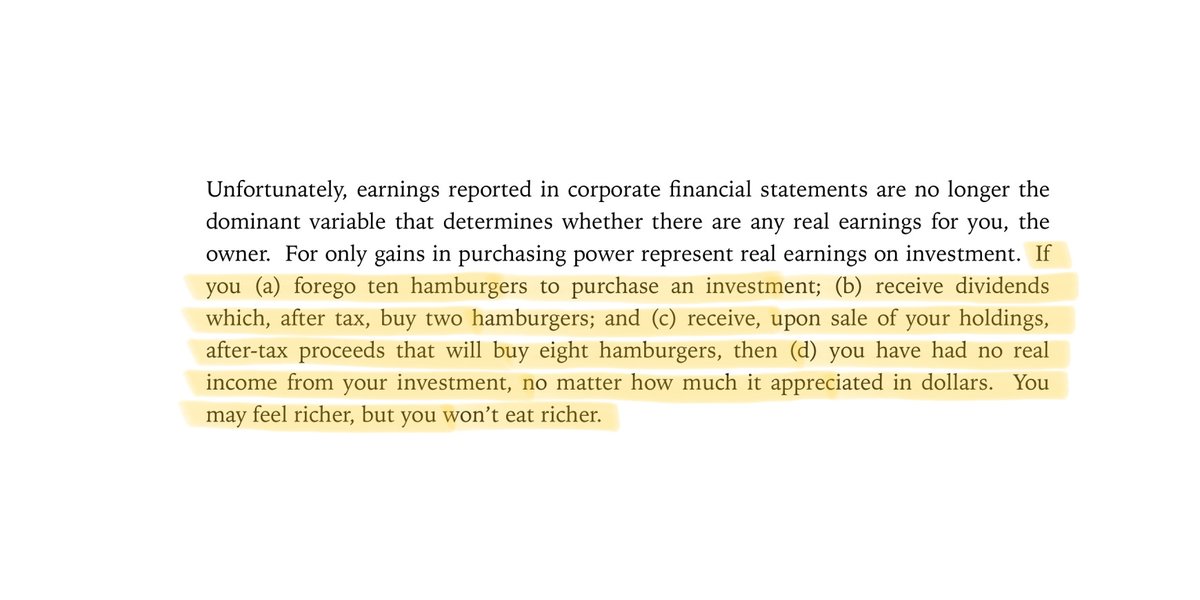

In this thread, I'll help you understand the relationships between *investing* and *inflation*. twitter.com

10-K Diver @10kdiver1/

Get a cup of coffee.

In this thread, I'll help you understand the relationships between *investing* and *inflation*. twitter.com Pay what you can

Pay what you can