menu

menu menu

menu

10-K Diver @10kdiver1/

Get a cup of coffee.

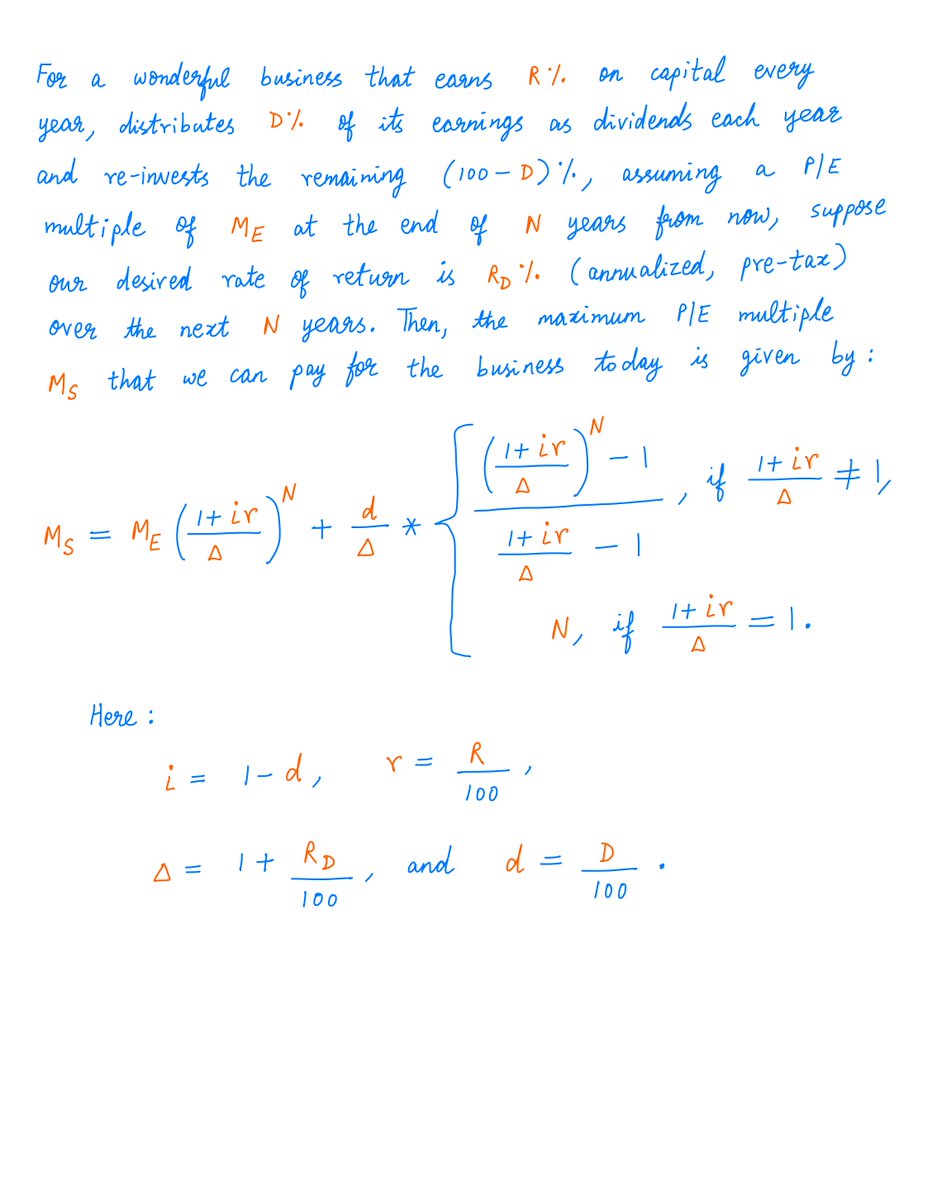

In this thread, I'll help you understand Warren Buffett's famous quote: it's better to buy a wonderful business at a fair price than a fair business at a wonderful price. twitter.com

10-K Diver @10kdiver1/

Get a cup of coffee.

In this thread, I'll help you understand Warren Buffett's famous quote: it's better to buy a wonderful business at a fair price than a fair business at a wonderful price. twitter.com

Pay what you can

Pay what you can